One of the best and most popular email newsletters I read is Matt Levine’s Money Stuff. It’s a must-read for folks in lots of finance and finance-adjacent circles, and stylistically one of a kind. Bloomberg, Levine’s employer, is a business, and a pretty good one at that. So why don’t they put his terrific content behind their paywall?

I have three ideas:

- Matt Levine likes having a big audience and wants to be in front of as many readers as possible. Bloomberg, not wanting anyone else to have Money Stuff, says, “ok, have it your way. If people like you, maybe they’ll like us too?”

- Bloomberg views Money Stuff as a good motivator to move their audience from the top of the funnel to the middle of the funnel.

- Matt Levine is making money for them in some much more effective way than gating email newsletters. Are the email ads better than the revenue from the paywall?

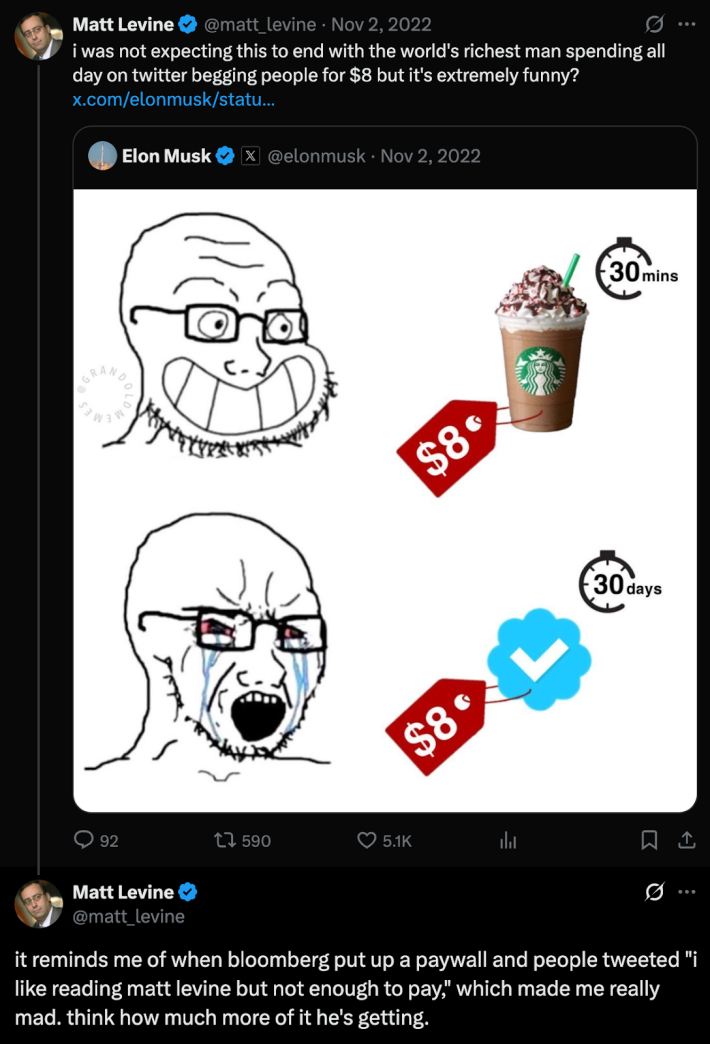

To test the first idea, we can do some basic qualitative research (I googled it).

The salient element here is his reply to his own tweet: “it reminds me of when bloomberg put up a paywall and people tweeted ‘i like reading matt levine but not enough to pay,” which made me really mad. think how much more of it he’s getting.” This somewhat discredits our idea that he wants his work to be free, but it doesn’t say anything about how much he likes it that hundreds of thousands of people get his work in his inbox, or how many fewer would get his newsletter if it were behind the paywall.

Ultimately, we should wonder if Matt’s preferences are a long-run driving force. If Matt says “I like being free” often enough, at some point Bloomberg says “okay cool, we like paying you less!” and they talk about it again. Maybe they talk about it once a year in perpetuity and there’s some equilibrium that makes them all happy enough. But we can’t know.

New Old Web is a blog published by Alley and Lede. We're researchers, strategists, designers, and developers who want to make the internet a fun place to live and work.

Ideas #2 and #3 could both be correct. The easiest thing to estimate is how much they’re making from advertising. Direct sold email CPMs can range from $3-10, and a Bloomberg radio host said on a podcast in 2024 that over 300k people get Money Stuff.

So we can develop an estimate for monthly revenue from advertisements. If the newsletter has stayed at the same size and commands a $10 CPM, 16 newsletters per month yields $48k. If it’s grown 10% since then, it’s more than $50k a month in sponsorship revenue. But there’s good reason to believe that Money Stuff is more valuable to sponsors even than that.

Bloomberg is selling a wealthy audience, most of whom probably work in finance or adjacent fields. The email Matt sent on November 3rd, 2025, was fully sponsored by Fidelity. In fact, it’s been sponsored by Fidelity since April 2, 2025, and Fidelity ads ran before that. So it may be safer to assume that this is one big fixed-cost campaign, and also that it’s likely that the total exceeds $100k per month given the audience and the top billing Fidelity receives. This may also be one component of a larger ad buy — but it’s a component they would’ve discussed, not something the sales team threw in to make Fidelity feel good. Or at least I would hope.

By that logic, Bloomberg can’t put the email behind the paywall. It needs to send lots of emails to make lots of money.

Then again, the revenue numbers from converting to a paywalled newsletter could be staggering, but they hinge on what number of readers are not paying subscribers already. Some are Bloomberg Terminal users, many more are already paying subscribers, we just don’t know how many. Still, if they convert 1,000 readers (that’s 0.03% of the 2024 total) to pay $40/month for Bloomberg, that’s $40k/month of revenue. And they still get to sell ads, albeit for somewhat less because the audience is now smaller. This supports the idea that the advertising numbers are larger than the $48k estimate based on the top end of generic CPMs. There’s some equilibrium where the smaller amount of ad revenue plus the subscription revenue would equal the larger amount of ad revenue, and the ad revenue puts them comfortably above that equilibrium.

Additionally, the funnel dynamics of Money Stuff aren’t binary — Matt links to paywalled Bloomberg articles almost every day, and sometimes even links into the Bloomberg Terminal. Pushing non-subscribers into the Bloomberg.com funnel is worth something on top of the ad fees.

And none of this takes into account the other things Matt does — a weekly podcast, opinion pieces that run on Bloomberg.com and in print, taking over an entire edition of BusinessWeek to explain crypto. He’s prolific!

As to the newsletter though, my belief is that Bloomberg is doing great from newsletter ad, so #3 is most likely correct. Even with the ad deals, they probably do gain something from his position in their audience funnel, so #2 could be a contributor, but likely not the primary driver given the overlap between Matt’s readers and Bloomberg’s paying customers. Idea #1, that Matt wants to be free, may be also be a contributing factor given the basic talent factor at play — he could take the show to any of the other big outlets, he could start his own thing on any platform, and it’d probably work out great.